The Single Strategy To Use For Clark Wealth Partners

Not known Factual Statements About Clark Wealth Partners

Table of ContentsThe smart Trick of Clark Wealth Partners That Nobody is DiscussingSome Known Details About Clark Wealth Partners The Single Strategy To Use For Clark Wealth PartnersNot known Facts About Clark Wealth PartnersTop Guidelines Of Clark Wealth PartnersAn Unbiased View of Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Discussing

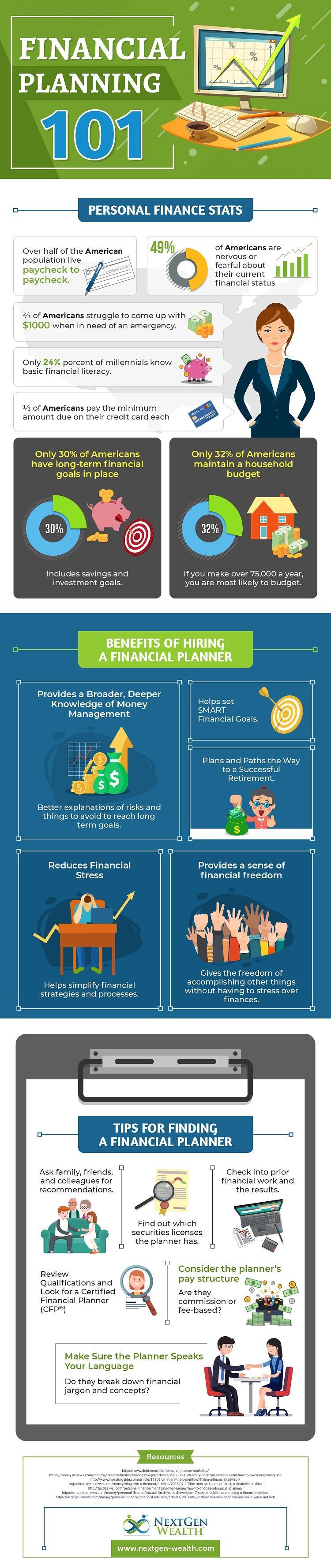

The globe of finance is a complex one. The FINRA Structure's National Capacity Research, as an example, recently located that almost two-thirds of Americans were unable to pass a basic, five-question financial proficiency examination that quizzed participants on topics such as passion, financial debt, and other fairly fundamental ideas. It's little marvel, after that, that we commonly see headlines regreting the inadequate state of a lot of Americans' financial resources (Tax planning in ofallon il).In addition to managing their existing clients, financial advisors will frequently invest a reasonable quantity of time weekly conference with possible customers and marketing their services to keep and expand their service. For those taking into consideration coming to be a monetary advisor, it is necessary to take into consideration the typical wage and task stability for those working in the area.

Courses in taxes, estate preparation, financial investments, and threat administration can be practical for students on this path. Relying on your unique job goals, you may also need to gain particular licenses to satisfy certain customers' demands, such as dealing stocks, bonds, and insurance coverage plans. It can also be handy to gain a certification such as a Certified Economic Organizer (CFP), Chartered Financial Analyst (CFA), or Personal Financial Professional (PFS).

How Clark Wealth Partners can Save You Time, Stress, and Money.

Many individuals decide to obtain help by utilizing the solutions of an economic professional. What that appears like can be a number of things, and can differ depending on your age and phase of life. Prior to you do anything, research study is essential. Some individuals fret that they need a certain amount of money to spend before they can obtain aid from an expert.

Not known Facts About Clark Wealth Partners

If you have not had any kind of experience with a monetary expert, below's what to expect: They'll begin by supplying a detailed evaluation of where you stand with your assets, obligations and whether you're fulfilling criteria contrasted to your peers for savings and retired life. They'll examine brief- and long-lasting objectives. What's helpful regarding this action is that it is customized for you.

You're young and working complete time, have an automobile or two and there are trainee car loans to pay off. Here are some feasible concepts to help: Establish great cost savings habits, repay financial debt, set baseline goals. Pay off student car loans. Depending on your occupation, you might qualify to have component of your institution finance forgoed.

Fascination About Clark Wealth Partners

You can talk about the following finest time for follow-up. Financial advisors normally have various rates of rates.

Constantly check out the great print, and make sure your economic expert complies with fiduciary criteria. You're looking in advance to your retirement and assisting your kids with college prices. A financial consultant can offer suggestions for those circumstances and even more. The majority of retirement use a set-it, forget-it choice that designates possessions based on your life phase.

Indicators on Clark Wealth Partners You Should Know

That might not be the most effective means to maintain building wide range, particularly as you advance in your career. Set up normal check-ins with your planner to modify your strategy as required. Stabilizing savings for retirement and college expenses for your youngsters can be difficult. An economic expert can help you prioritize.

Thinking of when you can retire and what post-retirement years could look like can produce concerns about whether your retirement financial savings are in line with your post-work strategies, or if you have conserved sufficient to leave a heritage. Aid your economic expert comprehend your strategy to cash. If you are a lot more conservative with saving (and prospective loss), their suggestions should respond to your concerns and problems.

The Only Guide to Clark Wealth Partners

Preparing for wellness treatment is one of the large unknowns in retirement, and a financial expert can lay out options and recommend whether extra insurance policy as security might be helpful. Prior to you start, attempt to obtain comfortable with the idea of sharing your entire financial picture with a specialist.

Providing your professional a full image can help them produce a strategy that's prioritized to all components of your monetary standing, specifically as you're rapid approaching your post-work years. If your finances are straightforward and you have a love for doing it on your own, you might be fine by yourself.

A monetary expert is not just for the super-rich; anyone encountering major life transitions, nearing retirement, or sensation bewildered by monetary choices might gain from expert support. This short article explores the duty of monetary experts, when you may need to get in touch with one, and essential considerations for picking - https://clark-wealth-partners.jimdosite.com/. A financial consultant is a skilled professional who aids clients manage their finances and make educated choices that align with their life objectives

The 45-Second Trick For Clark Wealth Partners

In contrast, commission-based consultants gain revenue through the financial items they sell, which may affect their recommendations. Whether it is marriage, divorce, the birth of a child, profession adjustments, or the loss of a loved one, these events have special monetary implications, typically More Bonuses calling for timely decisions that can have long lasting effects.